Governance

KBK will build mutual trust with the public by making every effort to disclose information accurately and quickly in accordance with our Basic Policy on Promotion of Sustainability, and listening to and fulfilling the expectations and demands from society through engaging in dialogue with stakeholders.

We have set the following targets in the medium-term management plan “KBK Plus-One 2025.”

- Disseminate corporate philosophy and mission statement throughout all Group companies

- Promote management in compliance with the Corporate Governance Code, establish Group corporate governance, and strengthen information security

- Provide compliance education and enforce compliance, including compliance with business-related laws and regulations

- Strengthen BCP measures, including those related to infectious diseases, and organization structure and systems for dealing with emergencies

Corporate Governance

- Basic Philosophy on Corporate Governance

-

The KBK Group engages in management that constantly aims to enhance corporate value by gaining further trust from all stakeholders including shareholders and investors. We recognize that enhancing management soundness through compliance with laws and conducting fair and highly transparent corporate activities are the ways to fulfill corporate social responsibility and enhance corporate social trust. Accordingly, the KBK Group, while regarding the establishment of corporate governance as a key priority, works to enhance the function of the Board of Directors and the Audit and Supervisory Committee, as well as strengthen the risk management system, increase awareness of compliance, and enhance the IR function.

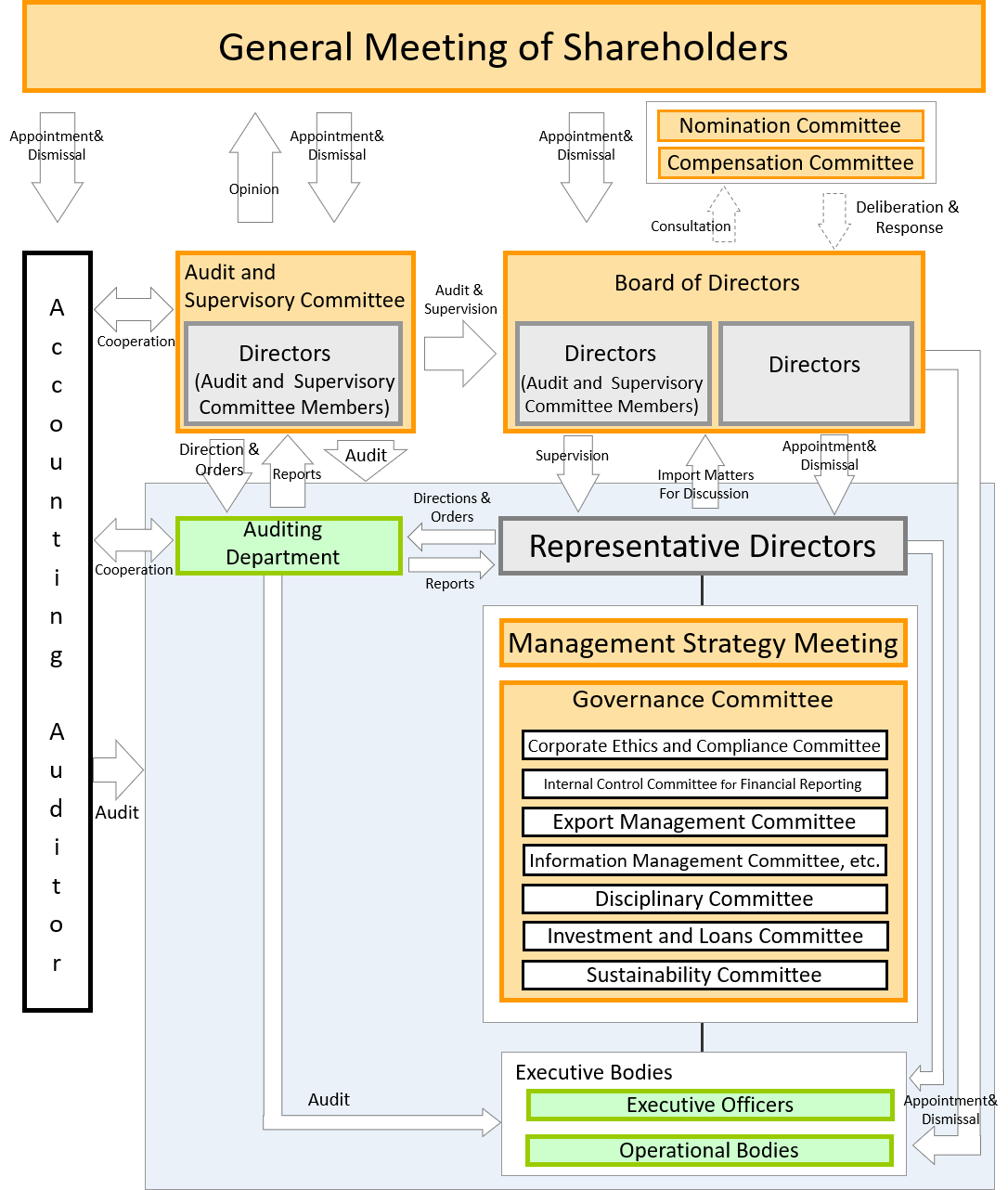

- Overview of Corporate Governance System

-

We consider that KBK’s current system of corporate governance, with the establishment of a Board of Directors and Audit and Supervisory Committee, is appropriate and reasonable from substantive perspectives including KBK’s scale and the nature of its business. We have introduced an executive officer system, and are endeavoring to strengthen the operation of various functional committees, primarily the Governance Committee, with an awareness of the guidance given in the Companies Act and Corporate Governance Code regarding strengthening the supervisory and audit functions. In addition, regarding important matters such as nomination and compensation, we have established a Nomination Committee and Compensation Committee, as discretionary advisory bodies under the Board of Directors, in order to strengthen the functional independence, objectivity and accountability of the Board of Directors on matters related to Directors’ nomination and compensation, and enhance corporate governance further.

The Board of Directors held on May 12, 2006 decided about the basic policy for building an internal control system based on the Companies Act and other relevant laws. When the Companies Act was revised, the Board of Directors passed a resolution on June 21, 2017 to revise the system to ensure that the business operations of the corporate group that comprises KBK and its subsidiaries are conducted appropriately, the system for Directors and employees of KBK and its subsidiaries to report to the Audit and Supervisory Committee Members, and other systems for reporting to the Audit and Supervisory Committee Members.

Going forward, we will continue to actively implement modern corporate governance approaches that meet the needs of society, and create systems that are more appropriate and efficient through measures such as reexamining the internal control system and other systems as needed.

Internal Control System

KBK will establish a basic policy for building an internal control system to ensure the appropriateness of business operations in accordance with the Companies Act and the Regulation for Enforcement of the Companies Act as follows. We will continuously assess and improve the maintenance and operation of the internal control system, and create systems that are more appropriate and efficient through measures such as reexamining the basic policy for building an internal control system as needed.

Matters Concerning the System to Ensure That the Performance of Duties by Directors and Employees of KBK and Its Subsidiaries Is in Compliance with Laws, Regulations, and the Articles of Incorporation

The Board of Directors will ensure that the duties of Directors and employees are executed in compliance with laws, regulations, and the articles of incorporation in accordance with the compliance system as stated below in “Internal Frameworks” under “Compliance.”

- Matters concerning the storage and management of information regarding the execution of Directors’ duties

-

- The Board of Directors will record information regarding the execution of its duties in writing or electronically, such as board meeting minutes and internal requests for approval, in accordance with the Regulations on Document Management and the Regulations on Document Storage, and other relevant regulations, and store and manage them properly in a way that is accessible to others.

- The Board of Directors will allow Directors and the Supportive Employee of the Audit and Supervisory Committee to view or copy information regarding execution of these duties at any time upon request.

- Matters Concerning Regulations on Managing Risk of Loss and Other Systems

-

- The Board of Directors will develop an appropriate system to increase the effectiveness of risk management and prevent or minimize the spread of damage by analyzing businesses risks recognized by KBK, establishing regulations that will serve as the basic policy to respond to said risks, assigning the division in charge to each risk and having them consider countermeasures, monitoring their implementation, and developing response manuals and other measures.

- Matters Concerning the System to Ensure the Execution of Directors’ Duties Are Performed Efficiently

-

The Board of Directors will work to improve the efficiency of the execution of Directors’ duties though the following corporate management system.

- KBK will hold regular monthly Board of Directors meetings in accordance with the Board of Directors Regulations, where Directors will make decisions on important matters and share information.

- The Board of Directors will formulate reasonable medium-term management plans of periods of three to five fiscal years as targets to be shared among Directors and employees.

- The Board of Directors will set company-wide performance targets and budgets for each fiscal year in accordance with the medium-term management plan, and allocate managerial resources needed to achieve said targets.

- The Board of Directors will delegate responsibility and authority to executive officers, clearly define the responsibilities and authority of the Management Strategy Meeting and managers under the Board of Directors in accordance with the Job Authority Regulations, and carry out efficient business management.

- Executive officers will direct operations to ensure management data such as monthly business results is promptly reported to the Board of Directors through the Director in charge, and the Board of Directors will review said data each month and receive reports on the analysis of factors for not achieving targets and improvement measures from the Director in charge, and deliberate on matters such as appropriately revising targets if necessary.

- Directors and executive officers will formulate and execute concrete plans and measures to be implemented based on the results of the deliberations of the Board of Directors, and oversee and direct the group in charge to achieve the targets.

- System to Ensure the Appropriateness of Business Operations of the Corporate Group That Comprises KBK and Its Subsidiaries

-

The Board of Directors will establish a division that manages the KBK Group within KBK to ensure subsidiaries’ business operations are conducted appropriately as follows.

- The Board of Directors will establish the Regulations on the Management of Subsidiaries and Affiliate Companies, which requires subsidiaries to report their budget, financial, and other information deemed necessary by KBK to KBK as needed.

- The Board of Directors will require KBK Directors and employees to serve concurrently as Directors of subsidiaries, and report the details of reports by subsidiaries’ Chief Executive Officer and other Executive Directors regarding the execution of duties of the subsidiaries’ Board of Directors to KBK.

- The President and Chief Executive Officer will hold regular meetings to which the Directors of KBK and its subsidiaries will attend, and require them to report on the operations of subsidiaries and other important matters.

- The Board of Directors will formulate regulations to respond to risks that affect the entire corporate group that comprises KBK and its subsidiaries, assign the division in charge to each risk in said regulations, and holistically and comprehensively manage risks that affect the entire corporate group that comprises KBK and its subsidiaries.

- The Board of Directors will formulate reasonable medium-term management plans of periods of three to five fiscal years as targets to be shared throughout the corporate group that comprises KBK and its subsidiaries, set performance targets and budgets for the entire corporate group that comprises KBK and its subsidiaries each fiscal year to flesh out said plans, and allocate managerial resources accordingly.

- The Board of Directors will formulate the Job Authority Regulations for Subsidiaries, define the responsibilities and authority of positions in subsidiaries, and require that they manage operations systematically and efficiently.

- The Audit and Supervisory Committee and the Internal Auditing Division will conduct investigations and internal audits of subsidiaries as needed based on the Internal Auditing Regulations and the Subsidiary and Affiliate Company Regulations.

- Matters Concerning an Employee Assisting the Duties of the Audit and Supervisory Committee in the Event the Appointment of Such Employee Is Requested by the Committee

-

- The Board of Directors will assign the Supportive Employee under the direct control of the Audit and Supervisory Committee when requested by the Committee, and said employee shall not take orders from Directors or others in regard to work to assist the duties of the Committee.

- The Supportive Employee shall have knowledge of business operations required by the Audit and Supervisory Committee, and carry out said operations in accordance with the directions of the Audit and Supervisory Committee.

- Matters Concerning the Independence of the Employees in the Preceding Item from Directors

-

- In the event the Board of Directors decides to transfer the employee in the preceding item, the Board shall report it to the Audit and Supervisory Committee in advance and provide the reason if necessary, and make a request to the Director in charge of personnel to make the change.

- If a Director decides to take disciplinary action against the employee in the preceding item, the Director in charge of personnel must obtain approval from the Audit and Supervisory Committee in advance.

- System for Directors and Employees of KBK and Its Subsidiaries to Report to the Audit and Supervisory Committee and Other Systems for Reporting to the Committee

-

- The Board of Directors shall require the Auditing Department to report legal matters and the results of audits conducted by the Auditing Department to the Audit and Supervisory Committee.

- The Board of Directors shall require relevant divisions to report other particularly important matters reported to the Management Strategy Meeting or brought before the meeting for discussion to the Audit and Supervisory Committee.

- Directors and employees of KBK, and Directors, Corporate Auditors, and employees of its subsidiaries shall provide information and necessary reports to the Audit and Supervisory Committee of KBK.

- The person who reports to the Audit and Supervisory Committee shall not be subjected to unfair treatment due to delivering said report.

- System for Ensuring That Other Audits by the Audit and Supervisory Committee Are Carried Out Effectively

-

- The Representative Director, Directors, and the Board of Directors shall make an active effort to communicate with the Audit and Supervisory Committee through means such as holding regular meetings.

- The Board of Directors shall require the Auditing Department, the Personnel & General Affairs Department and other management divisions to assist the administrative operations of the Audit and Supervisory Committee if necessary.

- If the Audit and Supervisory Committee requests for prepayment of costs or payment of debt incurred from the execution of said duties, the Board of Directors shall pay it, unless the execution of duties is determined to be unnecessary.

Compliance

In response to increasing awareness of corporate social responsibility across the globe due to the globalization of the economy, informatization, and changes in customers’ awareness, KBK is engaging in the following efforts to earn the trust of stakeholders through our interrelationship with society and the environment, focusing on the sustainable development of the entire corporate group led by KBK.

- Introduction of Standards

-

- Code of Conduct of the Kyokuto Boeki Group Companies

- Regulations on Handling Personal Information

- Privacy Policy

- Information Security Management Regulations

- Environmental Management Policy

- Guidelines on Green Purchasing

- Basic Policy on Promotion of Sustainability

- Thorough Dissemination

-

We will announce those standards internally, disseminate them repeatedly to employees, promote to develop an ethical environment within the group, to make them thoroughly known, and to establish them as part of the corporate culture so that all employees understand the management policy and act in compliance with laws and corporate ethics.

- Overview of Timely Disclosure System

-

KBK’s internal framework on the timely disclosure of corporate information is as follows.

- The disclosure process is as follows: Officers in charge compile and submit corporate disclosure information such as circumstances that occurred at KBK’s branches and offices, financial information, and information regarding subsidiaries and affiliate companies to the Corporate Planning Department — the department that handles information disclosure. Said information is then reported to and discussed and adjusted by the Auditing Department, Audit and Supervisory Committee, Accounting Auditor, and relevant departments to determine the necessity of disclosure, and then it is reported to the President, and if necessary resolved by the Board of Directors, before being disclosed.

- The President holds the Management Strategy Meeting when necessary in accordance with the Meeting Regulations, where management matters of top priority are discussed in advance and information is exchanged. Appropriate discussions are carried out at Board of Directors meetings: important matters are discussed based on the Board of Directors Regulations, and Audit and Supervisory Committee Members also attend Board meetings to state their opinions.

- KBK specifies the division of duties of managers in detail based on the Regulations for Division of Administrative Operations, and clearly defines their responsibilities and authority on decision-making, instilling policies among employees, and complying with laws and regulations based on the Job Authority Regulations. By deciding on these matters, KBK has put in place a system for systematically and efficiently performing business operations and systematically and quickly conveying company information within the company.

- The management and announcement of KBK’s internal information and standards of conduct for executives and employees are defined in the Regulations to Prevent Insider Trading, and managed appropriately.

- Internal Frameworks

-

In order to promote compliance with laws and regulations more thoroughly and strengthen compliance measures, KBK established the Corporate Ethics and Compliance Committee, which is under the direct control of the President and Chief Executive Officer. The Committee appoints an external attorney as the Chairperson to increase independence, and holds regular meetings to deliberate on measures concerning compliance. The Committee has also established the Help Line which serves as a whistleblowing desk to report business ethics and compliance violations, and designated an attorney’s office as an external help line. If further investigation is needed for a whistleblowing case, the Committee seeks advice and guidance from committee members who are attorneys or an attorney’s office which is an external help line to conduct the investigation fairly, neutrally, and properly.

In addition, KBK has defined the responsibilities and authority of organizations and positions, established a framework for the delegation of authority, and enhanced the system for inspection by the Inspection Division and the Investment and Loans Committee and checking after the fact by the Auditing Department. If a legal or other violation occurs, KBK will take strict and appropriate disciplinary action upon consulting with the Disciplinary Committee in accordance with the various regulations.

Risk Management

- Business Risks

-

The management recognizes the following matters regarding the KBK Group’s business conditions and financial position as the main risks that could have a major impact on the consolidated companies’ financial state, business results, and cash flow.

Matters concerning the future below were determined by the KBK Group in the fiscal period ended March 31, 2021.

- Risk Stemming from the Effects of the Macroeconomic Environment

-

The KBK Group conducts global business operations, and derives 40% of its net sales from export and import transactions and overseas transactions. Accordingly, the KBK Group is affected by the economic situation and trends of the purchasing country, supplying country or region of our products and services, and market in each country. Since export and import transactions with China account for a large share, the economic downturn and economic trends in the Chinese market may adversely affect the KBK Group’s business results and financial condition.

- Foreign Exchange Risk

-

Foreign currency denominated settlement in export and import transactions and overseas transactions by the KBK Group involves the risk of fluctuations in foreign exchange rates. Although the KBK Group hedges against such risk by means of foreign exchange contracts, there is no guarantee that the KBK Group can entirely avoid such risk.

In addition, since foreign currency denominated items including purchases and sales, expenses and assets stemming from transactions between the KBK Group and foreign companies are converted into yen, the value of these items in yen may be affected by the exchange rate at the time of conversion.

- Risk Related to Products

-

In the event that the KBK Group imports products and sells them in Japan, the KBK Group may be held liable in connection with product liability (PL) and may also be subject to claims for compensation for product defects at the export destination in the case that products are exported. Although the KBK Group hedges against such risk by means of PL insurance, there is no guarantee that such insurance can fully cover the final amount of damages. As it is conceivable that the amount of damages will be significant depending on the type of defects, the KBK Group’s business results and financial condition may be adversely affected.

- Risk Related to Investment

-

The KBK Group has entered a variety of business fields though third-party joint ventures and investment in third parties. However, the progress of such businesses may be difficult to predict because, in some cases, it depends on factors beyond the control of the KBK Group, such as the business results and financial position of the concerned business partner. As a result, the KBK Group may incur serious losses, which in turn may adversely affect the KBK Group’s business results and financial condition.

- Country Risk

-

Business operations in overseas markets, such as overseas transactions, investment, and capital and business alliances, are expected to entail risks stemming from changes in laws and regulations, political instability, unfavorable tax systems and economic factors, terrorism, war and other social turmoil due to the environment, economic climate and various circumstances of each country and region.

In addition, problems may arise in payment collection and business execution, due to unexpected events such as changes in the political situation, legal environment and tax systems, securing of manpower, and changes in economic conditions in countries in which the KBK Group conducts business activities.

- Risk Related to Competition

-

In the markets for the products and services provided by the KBK Group, competition has intensified in recent years due to existing competitors as well as progress in technological capabilities and the distribution of low-priced products especially in emerging countries. Even in this harsh environment, the KBK Group plans to further enhance its technological capabilities as an engineering trading company group and provide greater added value to customers in an effort to strengthen its profitability, while expanding business operations based on the overseas strategy and Group strategy. However, if the KBK Group is unable to provide products and technologies at competitive prices required by customers amid low-price competition and for newcomers, the KBK Group’s business results and business operations may be adversely affected.

- Risk Related to Change in the Time of Recording of Sales and Concentration of Business Results

-

Since the timing of recording net sales of the KBK Group changes according to the acceptance inspection period of customers and other factors, the timing may change from the initial plan. With regard to major projects for delivery of machinery or facilities and projects for government agencies in particular, delivery tends to be concentrated at the fiscal year-end in March. Accordingly, the postponement of delivery of projects scheduled for March and the acceptance inspection period of customers to the following fiscal year due to certain reasons, or the failure to receive orders for projects expected to be delivered in March, may adversely affect the KBK Group’s business results of the fiscal year under review.

- Risk Related to Securing of Executives and Employees

-

In the KBK Group’s business activities, the identification of engineering and advanced technologies largely relies on the abilities of executives and employees. Accordingly, it is essential to secure and develop outstanding human resources. The failure to secure such human resources may adversely affect the KBK Group’s business results and financial condition.

- Risk Related to Legal Regulations

-

In Japan and overseas, the KBK Group is subject to various laws in the course of its business operations. In addition, the KBK Group is subject to various regulations such as business and investment approvals, export restrictions, tariffs, and other export and import regulations due to national security and other reasons.

The costs borne to comply with such laws and regulations may increase, and the failure to comply with such laws and regulations will result in penalties and fines as well as a loss of trust due to the restriction of the KBK Group’s business activities. This in turn may adversely affect the KBK Group’s business results and financial condition.

- Risk Related to Retirement Benefit Expenses and Liabilities

-

The KBK Group’s employee retirement benefit expenses and liabilities are calculated based on assumptions made in connection with the discount rate and other actuarial calculations, and the long-term expected rate of return on pension assets. If the actual results differ from the assumptions, or if the assumptions are changed, future expenses and liabilities to be recorded will be affected. A decrease in the discount rate and a deterioration in the rate of return may adversely affect the KBK Group’s business results and financial condition.

- Risk Related to Lawsuits and Other Actions

-

The KBK Group may unexpectedly be ordered to pay compensation after a lawsuit or other action is brought against it in the course of conducting business, which in turn may adversely affect the KBK Group’s business results and financial condition.

- Risk Related to Natural and Other Disasters

-

Although the KBK Group will take action in accordance with the business continuity plan (BCP) in the event a natural disaster such as an earthquake or typhoon occurs or there is an outbreak of a new infectious disease, delays or interruptions in the KBK Group’s businesses could occur due to obstacles in the supply chain or the procurement and provision of products, which may adversely affect the KBK Group’s business results and financial condition.

- Risk Related to the COVID-19 Pandemic

-

The COVID-19 pandemic has had a huge impact on the entire global economy, including reversing previous progress in globalization, blocking the movement of people and things, and causing a sharp decline in spending and production activities.

Thanks to making headway in vaccinations, hopes are high that the pandemic will wind down, but phenomena that greatly impact international affairs continue to occur such as the spread of infection from variants and huge discrepancies in countries’ responses to COVID-19. Furthermore, uncertainties in the future of international travel restrictions for engineers and others could lead to delays in delivery times and acceptance inspections, which may adversely affect the KBK Group’s business results and financial condition.